News & Updates

LEIBOVIT VR NEWSLETTERS - WEEKLY HOWE STREET PODCAST - FRIDAY - MAY 3, 2O24 - SELL MAY AND GO AWAY

https://www.howestreet.com/2024/05/us-marijuana-stocks-going-sky-high-mark-leibovit/

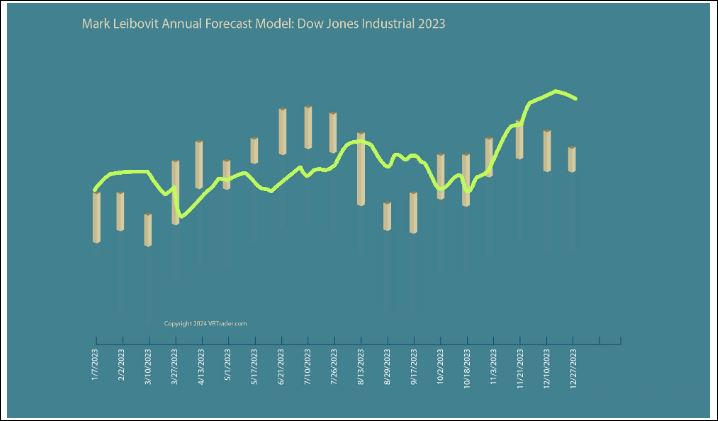

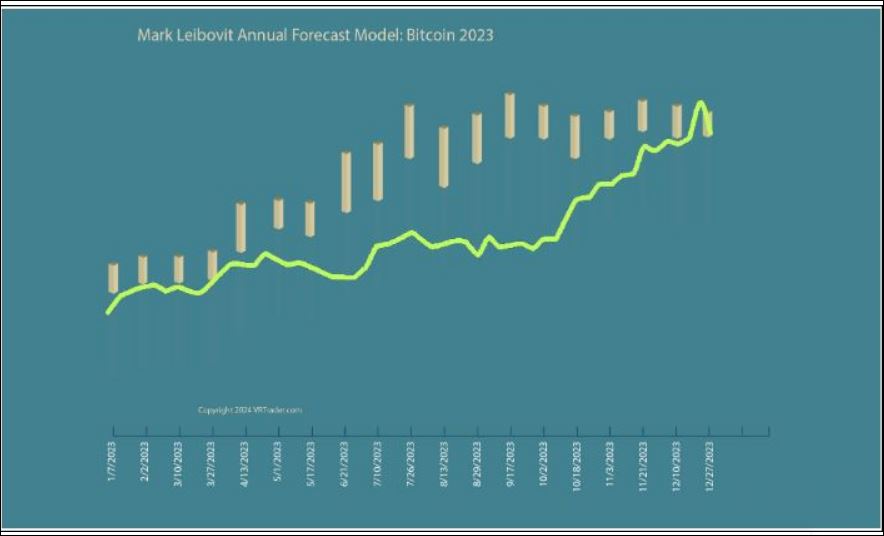

THE VR FORECASTER - ANNUAL FORECAST MODEL

ORDER TODAY AND WE WILL MANUALLY EMAIL YOU THE REPORT BEFORE IT IS POSTED ON THE WEBSITE

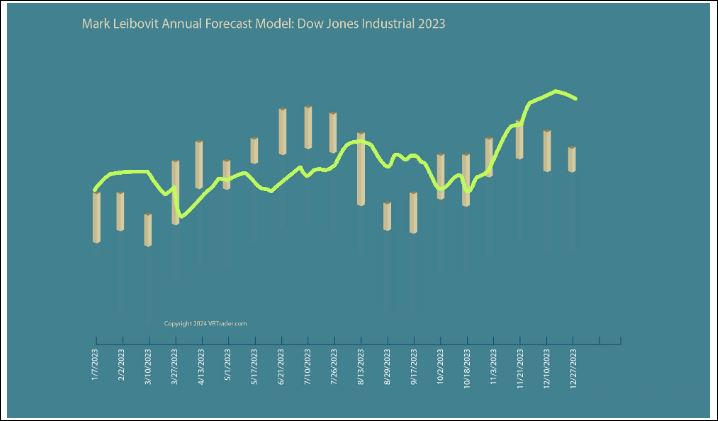

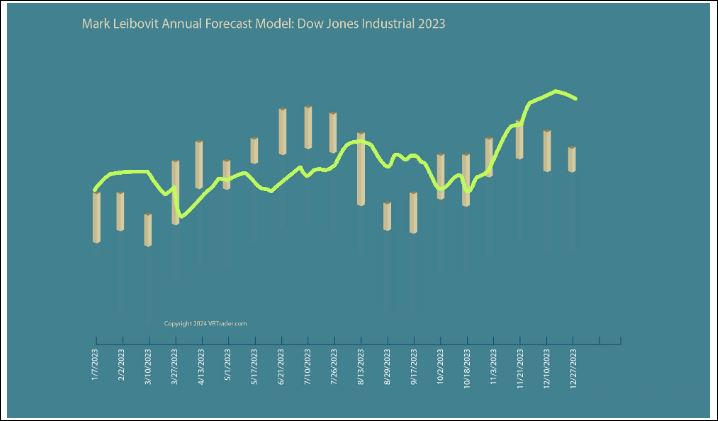

HERE IS THE 2023 ANNUAL FORECAST MODEL WITH THE 'RESULTS' SUPERIMPOSED

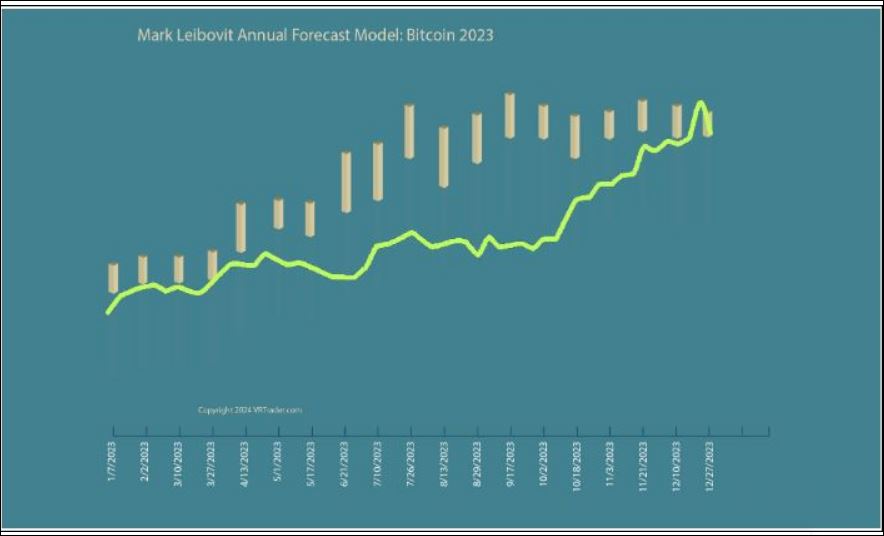

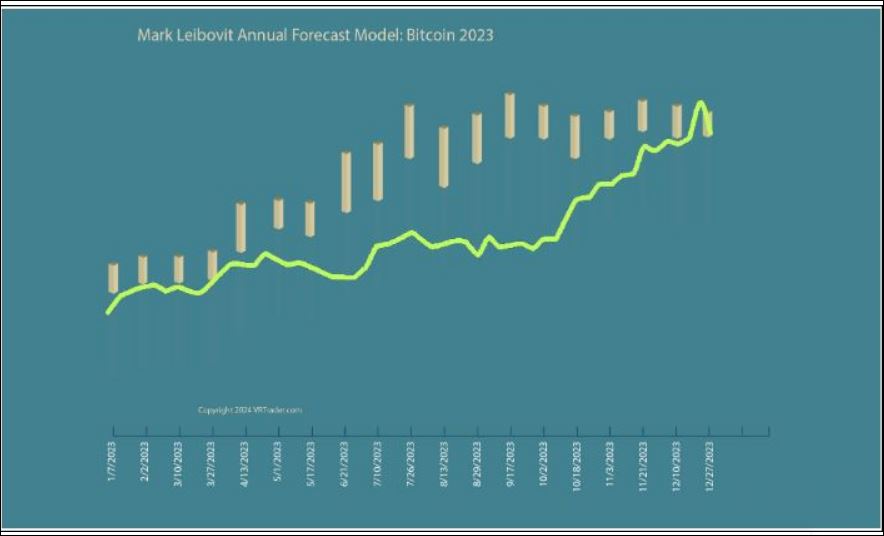

HERE IS THE 2023 ANNUAL FORECAST MODEL FOR BITCOIN WITH THE 'RESULTS' SUPERIMPOSED

ORDER PAGE

http://tinyurl.com/5f7wb6zs

WHO IS MARK LEIBOVIT?

MARK LEIBOVIT is Chief Market Strategist for LEIBOVIT VR NEWSLETTERS a/k/a VRTrader.Com. His technical expertise is in overall market timing and stock selection based upon his proprietary VOLUME REVERSAL (TM) methodology and Annual Forecast Model.

Mark's extensive media television profile includes seven years as a consultant ‘Elf’ on “Louis Rukeyser’s Wall Street Week” television program, and over thirty years as a Market Monitor guest for PBS “The Nightly Business Report”. He also has appeared on Fox Business News, CNBC, BNN (Canada), and Bloomberg, and has been interviewed in Barrons, Business Week, Forbes and The Wall Street Journal and Michael Campbell's MoneyTalks.

In the January 2, 2020 edition of TIMER DIGEST MAGAZINE, Mark Leibovit was ranked the #1 U.S. Stock Market Timer and was previously ranked #1 Intermediate U.S. Market Timer for the ten year period December, 1997 to 2007.

He was a 'Market Maker' on the Chicago Board Options Exchange and the Midwest Options Exchange and then went on to work in the Research department of two Chicago based brokerage firms. Mr. Leibovit now publishes a series of newsletters at www.LeibovitVRNewsletters.com. He became a member of the Market Technicians Association in 1982.

Mr. Leibovit’s specialty is Volume Analysis and his proprietary Leibovit Volume Reversal Indicator is well known for forecasting accurate signals of trend direction and reversals in the equity, metals and futures markets. He has historical experience recognizing, bull and bear markets and signaling alerts prior to market crashes. His indicator is currently available on the Metastock platform.

His comprehensive study on Volume Analysis, The Trader’s Book of Volume published by McGraw-Hill is a definitive guide to volume trading. It is now also published in Chinese. Mark has appeared in speaking engagements and seminars in the U.S. and Canada

U.S. Stocks Rally Amid Easing Worries About Possible Rate Hike

Stocks fluctuated early in the session on Thursday before moving sharply higher over the course of the trading day. The major averages all showed strong moves to the upside after ending Wednesday's trading narrowly mixed.

The major averages pulled back off their best levels going into the close but remained firmly positive. The Dow jumped 322.37 points or 0.9 percent to 38,225.66, the Nasdaq surged 235.48 points or 1.5 percent to 15,840.96 and the S&P 500 advanced 45.81 points or 0.9 percent at 5,064.20.

The strength that emerged on Wall Street came as traders seemed to breathe a sigh of relief following the Federal Reserve's monetary policy announcement on Wednesday.

Traders have recently expressed some concerns the Fed's next monetary policy move could actually be an interest rate hike rather than a cut, but Fed Chair Jerome Powell post-meeting remarks seem to have alleviated those worries.

"Not only did Powell choose not to give a hawkish press conference, he took great pains to be dovish," said Chris Zaccarelli, Chief Investment Officer for Independent Advisor Alliance. "At every turn he looked on the bright side of data - from higher-than-expected inflation to recent lower-than-expected economic growth - and dismissed any suggestions that the Fed was pivoting from rate cuts to rate hikes."

He added, "He explicitly said he believes their next move would be a cut - even if it will take longer to get to that cut than they believed a short time ago - and set the bar extremely high for rate hikes."

Earlier in the day, stocks saw considerable volatility as traders reacted to the latest batch of U.S. economic data, including a Labor Department report showing a surge by labor costs in the first quarter of 2024.

The Labor Department said unit labor costs soared by 4.7 percent in the first quarter following a revised unchanged reading in the fourth quarter.

Economists had expected labor costs to shoot up by 3.2 percent compared to the 0.4 percent increase that had been reported for the previous quarter.

"Productivity growth wasn't strong enough to significantly mitigate the rise in wages last quarter," said Nationwide Financial Markets Economist Oren Klachkin. "The strong rise in unit labor costs is another in a string of recent data points indicating that inflation pressures remain relatively high."

A separate Labor Department showed initial jobless claims came in unchanged last week, while a Commerce Department report showed the U.S. trade deficit narrowed slightly in March.

Sector News

Transportation stocks moved sharply higher over the course of the session, resulting in a 2.5 percent spike by the Dow Jones Transportation Average.

Avis Budget (CAR) and C.H. Robinson Worldwide (CHRW) skyrocketed on the day after reporting their quarterly results.

Substantial strength also emerged among semiconductor stocks, as reflected by the 2.2 percent surge by the Philadelphia Semiconductor Index.

Retail stocks also showed a significant move to the upside as the day progressed, driving the Dow Jones U.S. Retail Index up by 2.0 percent.

Housing, computer hardware and brokerage stocks also saw considerable strength, while pharmaceutical stocks bucked the uptrend.

Other Markets

In overseas trading, stock markets across the Asia-Pacific region turned in a mixed performance on Thursday. While Hong Kong's Hang Seng Index surged by 2.5 percent, Japan's Nikkei 225 Index edged down by 0.1 percent and South Korea's Kospi dipped by 0.3 percent.

The major European markets also ended the day mixed. While the U.K.'s FTSE 100 Index climbed by 0.6 percent, the German DAX Index slipped by 0.2 percent and the French CAC 40 Index slid by 0.9 percent.

In the bond market, treasuries moved modestly higher over the course of the session after seeing early weakness. Subsequently, the yield on the benchmark ten-year note, which moves opposite of its price, dipped 2.4 basis points to 4.571 percent after reaching a high of 4.651 percent.

Looking Ahead

The Labor Department's monthly jobs report is likely to be in the spotlight on Friday, although a report on service sector activity may also attract attention.

On the earnings front, tech giant Apple (AAPL) is among the companies releasing their quarterly results after the close of today's trading.

https://tinyurl.com/2rd9wv52

OPPORTUNITY TO ACCESS MARK LEIBOVIT'S PROPRIETARY VOLUME REVERSAL INDICATOR - THIS IS THE ONLY PLACE TO DO IT!

https://www.metastock.com/prod

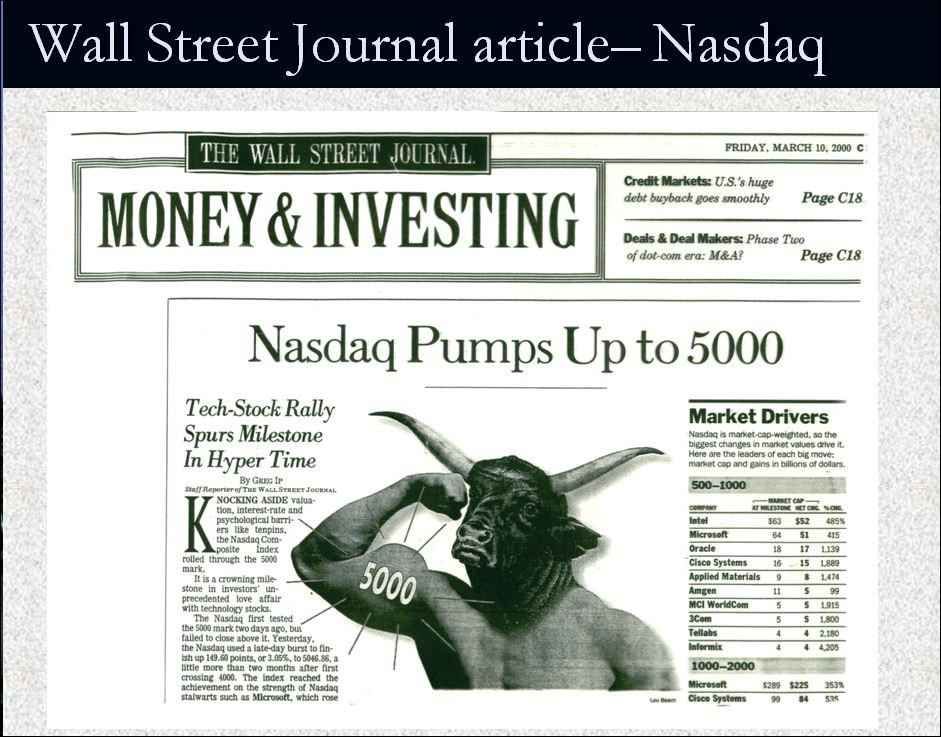

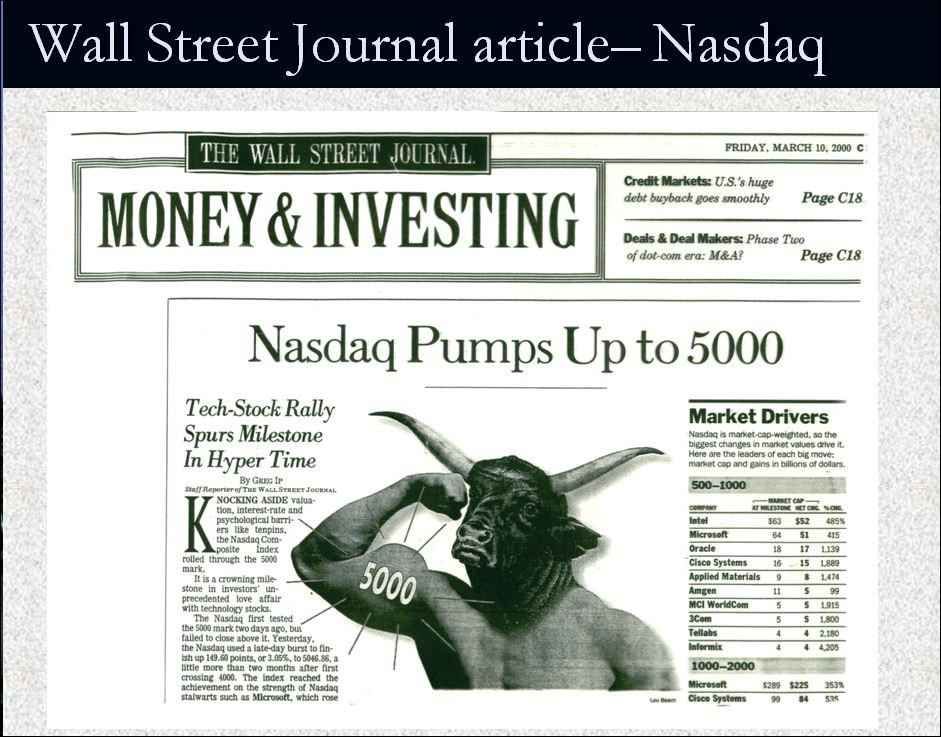

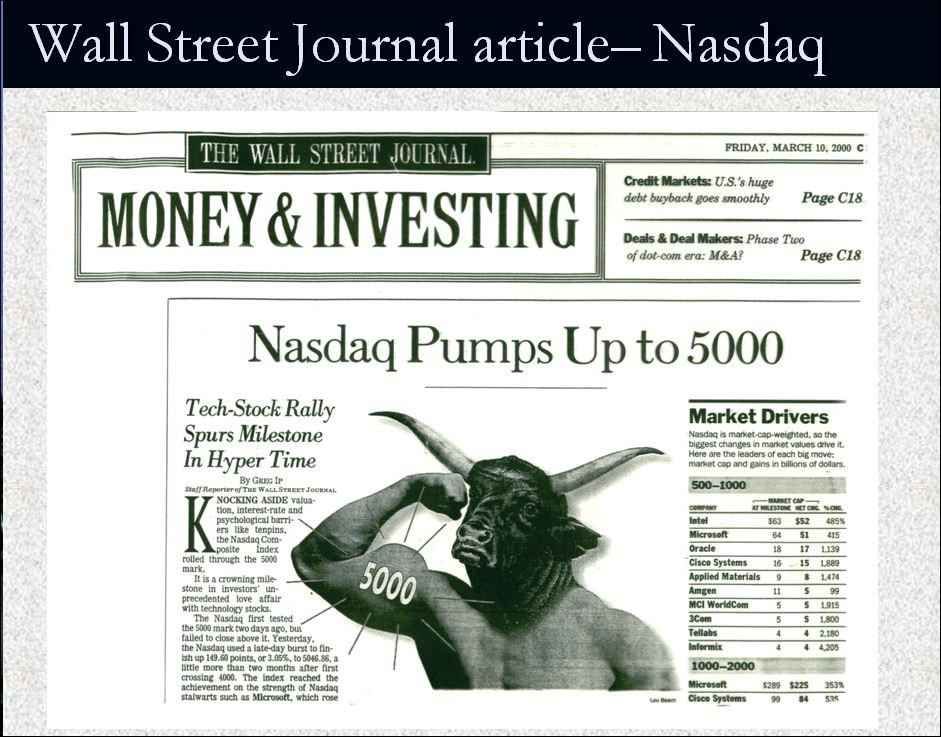

FOLKS THIS ALL YOU NEEDED TO KNOW! HISTORICALLY A GOOD SIGN THAT WE ARE AT OR NEAR A MARKET TOP = BULLISH MEDIA HEADLINES LIKE THIS. RECALL THE MARCH 10, 2000 TOP HEADLINE IN THE WALL STREET JOURNAL (BELOW) RIGHT AT THE TOP!

DID YOU MISS THE RECENT METASTOCK MARK LEIBOVIT WEBINAR - POWERPOINT?

https://tinyurl.com/yc45s35c

COME ON, DAD. IT'S TIME TO EAT

DISCLAIMER:

WE ARE NOT FINANCIAL ADVISORS AND DO NOT PROVIDE FINANCIAL ADVICE

The website, LeibovitVRNewsletters.com, is published by LeibovitVRNewsletters LLC.

In using LeibovitVRnewsletters.com (a/k/a LeibovitVRNewsletters LLC) you agree to these Terms & Conditions governing the use of the service. These Terms & Conditions are subject to change without notice. We are publishers and are not registered as a broker-dealer or investment adviser either with the U.S. Securities and Exchange Commission or with any state securities authority.

All stocks and ETFs discussed are HYPOTHETICAL and not actual trades whose actual execution may differ markedly from prices posted on the website and in emails. This may be due internet connectivity, quote delays, data entry errors and other market conditions. Hypothetical or simulated performance results have certain inherent limitations as to liquidity and execution among other variables. PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE FORECASTING ACCURACY OR PROFITABLE TRADING RESULTS.

All investments are subject to risk, which should be considered on an individual basis before making any investment decision. We are not responsible for errors and omissions. These publications are intended solely for information and educational purposes only and the content within is not to be construed, under any circumstances, as an offer to buy or to sell or a solicitation to buy or sell or trade in any commodities or securities named within.

All commentary is provided for educational purposes only. This material is based upon information we consider reliable. However, accuracy is not guaranteed. Subscribers should always do their own investigation before investing in any security. Furthermore, you cannot be assured that your will profit or that any losses can or will be limited. It is important to know that no guarantee of any kind is implied nor possible where projections of future conditions in the markets are attempted.

Stocks and ETFs may be held by principals of LeibovitVRNewsletters LLC whose personal investment decisions including entry and exit points may differ from guidelines posted.

LeibovitVRNewsletters.com cannot and do not assess, verify or guarantee the suitability or profitability of any particular investment. You bear responsibility for your own investment research and decisions and should seek the advice of a qualified securities professional before making any investment. As an express condition of using this service and anytime after ending the service, you agree not to hold LeibovitVRNewsletters.com or any employees liable for trading losses, lost profits or other damages resulting from your use of information on the Site in any form (Web-based, email-based, or downloadable software), and you agree to indemnify and hold LeibovitVRNewsletters.com and its employees harmless from and against any and all claims, losses, liabilities, costs, and expenses (including but not limited to attorneys' fees) arising from your violation of this agreement. This paragraph is not intended to limit rights available to you or to us that may be available under the federal securities laws.

For rights, permissions, subscription and customer service, contact the publisher at mark.vrtrader@gmail.com or call at 928-282-1275 or mail to 10632 N. Scottsdale Road B-426, Scottsdale, AZ 85254.

The Leibovit Volume Reversal, Volume Reversal and Leibovit VR are registered trademarks.

© Copyright 2024. All rights reserved.

LEIBOVIT VR NEWSLETTERS - MAY 2, 2024 - MAY DAY CELEBRATIONS ON THE LEFT CONTINUE

I CALL CORRECTLY CALLED A BULL TRAP. WHY DID CNBC, FOX NEWS, THE WALL STREET JOURNAL HIDE THIS FROM YOU?

THE VR FORECASTER - ANNUAL FORECAST MODEL

ORDER TODAY AND WE WILL MANUALLY EMAIL YOU THE REPORT BEFORE IT IS POSTED ON THE WEBSITE

HERE IS THE 2023 ANNUAL FORECAST MODEL WITH THE 'RESULTS' SUPERIMPOSED

HERE IS THE 2023 ANNUAL FORECAST MODEL FOR BITCOIN WITH THE 'RESULTS' SUPERIMPOSED

ORDER PAGE

http://tinyurl.com/5f7wb6zs

https://www.howestreet.com/2024/04/big-reversal-patterns-following-profit-reports-mark-leibovit/

WHO IS MARK LEIBOVIT?

MARK LEIBOVIT is Chief Market Strategist for LEIBOVIT VR NEWSLETTERS a/k/a VRTrader.Com. His technical expertise is in overall market timing and stock selection based upon his proprietary VOLUME REVERSAL (TM) methodology and Annual Forecast Model.

Mark's extensive media television profile includes seven years as a consultant ‘Elf’ on “Louis Rukeyser’s Wall Street Week” television program, and over thirty years as a Market Monitor guest for PBS “The Nightly Business Report”. He also has appeared on Fox Business News, CNBC, BNN (Canada), and Bloomberg, and has been interviewed in Barrons, Business Week, Forbes and The Wall Street Journal and Michael Campbell's MoneyTalks.

In the January 2, 2020 edition of TIMER DIGEST MAGAZINE, Mark Leibovit was ranked the #1 U.S. Stock Market Timer and was previously ranked #1 Intermediate U.S. Market Timer for the ten year period December, 1997 to 2007.

He was a 'Market Maker' on the Chicago Board Options Exchange and the Midwest Options Exchange and then went on to work in the Research department of two Chicago based brokerage firms. Mr. Leibovit now publishes a series of newsletters at www.LeibovitVRNewsletters.com. He became a member of the Market Technicians Association in 1982.

Mr. Leibovit’s specialty is Volume Analysis and his proprietary Leibovit Volume Reversal Indicator is well known for forecasting accurate signals of trend direction and reversals in the equity, metals and futures markets. He has historical experience recognizing, bull and bear markets and signaling alerts prior to market crashes. His indicator is currently available on the Metastock platform.

His comprehensive study on Volume Analysis, The Trader’s Book of Volume published by McGraw-Hill is a definitive guide to volume trading. It is now also published in Chinese. Mark has appeared in speaking engagements and seminars in the U.S. and Canada

Why is May Day not celebrated in the US?

The history of May Day in America according to the communist NPR because of anti-communist attitudes during the Cold War, as well as opposition to working-class unity, led authorities to suppress May Day's association with labor movements. Isn't that funny. Who are the communists in our country today?

Now to the markets which are headed south!

U.S. Stocks Close Mixed Following Post-Fed Volatility

After turning in a lackluster performance for much of the session, stocks saw substantial volatility following the Federal Reserve's monetary policy announcement Wednesday afternoon. The major averages initially surged in reaction to the Fed announcement but pulled back going into the close.

The major averages eventually finished the day mixed. While the Dow rose 87.37 points or 0.2 percent to 37,903.29, the Nasdaq fell 52.34 points or 0.3 percent to 15,605.48 and the S&P 500 dipped 17.30 points or 0.3 percent to 5,018.39.

The late-day volatility came after the Federal Reserve announced its widely expected decision to leave interest rates unchanged.

Citing a lack of further progress toward its 2 percent inflation objective in recent months, the Fed said it decided to maintain the target range for the federal funds rate at 5.25 to 5.50 percent

Members of the Fed also reiterated they need "greater confidence" inflation is moving sustainably toward 2 percent before they consider cutting interest rates.

Meanwhile, the Fed said it would continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities but revealed plans to slow the pace of decline.

The central bank said would slow the pace of decline of its securities holdings by reducing the monthly redemption cap on Treasury securities from $60 billion to $25 billion.

The monthly redemption cap on agency debt and agency mortgage-backed securities will be maintained at $35 billion, and the Fed will reinvest any principal payments in excess of this cap into Treasury securities.

"In continuation with the wait-and-see policy that has been in place, Chairman Powell is buying some time by diverting attention of this meeting towards the Fed's balance sheet and focusing on reducing the runoff pace of their Treasury holdings," said Charlie Ripley, Senior Investment Strategist for Allianz Investment Management.

He added, "Ultimately, today's policy decision was a well-rounded approach to give the Fed more time to gain confidence in the path of inflation, but we suspect they remain ready to cut knowing that the interest rate curve has remained inverted for the longest period on record."

The Fed's next monetary policy meeting is scheduled for June 11-12, with the central bank likely to leave rates unchanged once again.

On the economic data front, payroll processor ADP released a report showing private sector employment increased by more than expected in the month of April.

ADP said private sector employment shot up by 192,000 jobs in April after jumping by an upwardly revised 208,000 jobs in March.

Economists had expected private sector employment to climb by 175,000 jobs compared to the addition of 184,000 jobs originally reported for the previous month.

Meanwhile, the Institute for Supply Management released a separate report showing a modest contraction by U.S. manufacturing activity in the month of April.

The ISM said its manufacturing PMI slipped to 49.2 in April from 50.3 in March, with a reading below 50 indicating contraction. Economists had expected the index to edge down to 50.0.

The slight pullback by the index came after it indicated a modest expansion in March following sixteen consecutive months of contraction.

Sector News

Semiconductor stocks showed a substantial move to the downside on the day, resulting in a 3.5 percent nosedive by the Philadelphia Semiconductor Index.

Advanced Micro Devices (AMD) led the sector lower, plunging by 9.0 percent despite reporting slightly better than expected first quarter results. Traders may have been disappointed AMD provided second quarter sales guidance in line with analyst estimates.

Significant weakness was also visible among computer hardware stocks, as reflected by the 2.0 percent slump by the NYSE Arca Computer Hardware Index.

Shares of Super Micro Computer (SMCI) plummeted by 14.0 percent after the high efficiency server maker reported weaker than expected fiscal third quarter revenues.

Energy stocks also saw considerable weakness amid a steep drop by the price of crude oil, while biotechnology, utilities and telecom stocks showed strong moves to the upside.

Other Markets

In overseas trading, Japanese and Australian stocks moved lower on Wednesday, with most markets in the Asia-Pacific region closed for Labor Day. Japan's Nikkei 225 Index dipped by 0.3 percent, while Australia's S&P/ASX 200 Index slumped by 1.2 percent.

While most of the major European markets were also closed on the day, U.K. stocks moved modestly lower. The U.K.'s FTSE 100 Index ended the day down by 0.3 percent.

In the bond market, treasuries moved sharply higher in reaction to the Fed announcement. As a result, the yield on the benchmark ten-year note, which moves opposite of its price, tumbled 9.1 basis points to 4.595 percent.

Looking Ahead

Trading on Thursday may continue to be impacted by reaction to the Fed announcement, while reports on weekly jobless claims, the U.S. trade deficit and labor productivity and costs may also attract attention.

https://tinyurl.com/2rd9wv52

OPPORTUNITY TO ACCESS MARK LEIBOVIT'S PROPRIETARY VOLUME REVERSAL INDICATOR - THIS IS THE ONLY PLACE TO DO IT!

https://www.metastock.com/prod

FOLKS THIS ALL YOU NEEDED TO KNOW! HISTORICALLY A GOOD SIGN THAT WE ARE AT OR NEAR A MARKET TOP = BULLISH MEDIA HEADLINES LIKE THIS. RECALL THE MARCH 10, 2000 TOP HEADLINE IN THE WALL STREET JOURNAL (BELOW) RIGHT AT THE TOP!

DID YOU MISS THE RECENT METASTOCK MARK LEIBOVIT WEBINAR - POWERPOINT?

https://tinyurl.com/yc45s35c

COME ON, DAD. IT'S TIME TO EAT

DISCLAIMER:

WE ARE NOT FINANCIAL ADVISORS AND DO NOT PROVIDE FINANCIAL ADVICE

The website, LeibovitVRNewsletters.com, is published by LeibovitVRNewsletters LLC.

In using LeibovitVRnewsletters.com (a/k/a LeibovitVRNewsletters LLC) you agree to these Terms & Conditions governing the use of the service. These Terms & Conditions are subject to change without notice. We are publishers and are not registered as a broker-dealer or investment adviser either with the U.S. Securities and Exchange Commission or with any state securities authority.

All stocks and ETFs discussed are HYPOTHETICAL and not actual trades whose actual execution may differ markedly from prices posted on the website and in emails. This may be due internet connectivity, quote delays, data entry errors and other market conditions. Hypothetical or simulated performance results have certain inherent limitations as to liquidity and execution among other variables. PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE FORECASTING ACCURACY OR PROFITABLE TRADING RESULTS.

All investments are subject to risk, which should be considered on an individual basis before making any investment decision. We are not responsible for errors and omissions. These publications are intended solely for information and educational purposes only and the content within is not to be construed, under any circumstances, as an offer to buy or to sell or a solicitation to buy or sell or trade in any commodities or securities named within.

All commentary is provided for educational purposes only. This material is based upon information we consider reliable. However, accuracy is not guaranteed. Subscribers should always do their own investigation before investing in any security. Furthermore, you cannot be assured that your will profit or that any losses can or will be limited. It is important to know that no guarantee of any kind is implied nor possible where projections of future conditions in the markets are attempted.

Stocks and ETFs may be held by principals of LeibovitVRNewsletters LLC whose personal investment decisions including entry and exit points may differ from guidelines posted.

LeibovitVRNewsletters.com cannot and do not assess, verify or guarantee the suitability or profitability of any particular investment. You bear responsibility for your own investment research and decisions and should seek the advice of a qualified securities professional before making any investment. As an express condition of using this service and anytime after ending the service, you agree not to hold LeibovitVRNewsletters.com or any employees liable for trading losses, lost profits or other damages resulting from your use of information on the Site in any form (Web-based, email-based, or downloadable software), and you agree to indemnify and hold LeibovitVRNewsletters.com and its employees harmless from and against any and all claims, losses, liabilities, costs, and expenses (including but not limited to attorneys' fees) arising from your violation of this agreement. This paragraph is not intended to limit rights available to you or to us that may be available under the federal securities laws.

For rights, permissions, subscription and customer service, contact the publisher at mark.vrtrader@gmail.com or call at 928-282-1275 or mail to 10632 N. Scottsdale Road B-426, Scottsdale, AZ 85254.

The Leibovit Volume Reversal, Volume Reversal and Leibovit VR are registered trademarks.

© Copyright 2024. All rights reserved.

LEIBOVIT VR NEWSLETTERS - WEDNESDAY - MAY 1, 2024 - BIG DAY FOR OUR CANNABIS STOCKS WEDNESDAY! HOPE YOU WERE ON BOARD - P.S. TRAVELING THE REST OF THE WEEK!

I CALL CORRECTLY CALLED A BULL TRAP. WHY DID CNBC, FOX NEWS, THE WALL STREET JOURNAL HIDE THIS FROM YOU?

THE VR FORECASTER - ANNUAL FORECAST MODEL

ORDER TODAY AND WE WILL MANUALLY EMAIL YOU THE REPORT BEFORE IT IS POSTED ON THE WEBSITE

HERE IS THE 2023 ANNUAL FORECAST MODEL WITH THE 'RESULTS' SUPERIMPOSED

HERE IS THE 2023 ANNUAL FORECAST MODEL FOR BITCOIN WITH THE 'RESULTS' SUPERIMPOSED

ORDER PAGE

http://tinyurl.com/5f7wb6zs

https://www.howestreet.com/2024/04/big-reversal-patterns-following-profit-reports-mark-leibovit/

WHO IS MARK LEIBOVIT?

MARK LEIBOVIT is Chief Market Strategist for LEIBOVIT VR NEWSLETTERS a/k/a VRTrader.Com. His technical expertise is in overall market timing and stock selection based upon his proprietary VOLUME REVERSAL (TM) methodology and Annual Forecast Model.

Mark's extensive media television profile includes seven years as a consultant ‘Elf’ on “Louis Rukeyser’s Wall Street Week” television program, and over thirty years as a Market Monitor guest for PBS “The Nightly Business Report”. He also has appeared on Fox Business News, CNBC, BNN (Canada), and Bloomberg, and has been interviewed in Barrons, Business Week, Forbes and The Wall Street Journal and Michael Campbell's MoneyTalks.

In the January 2, 2020 edition of TIMER DIGEST MAGAZINE, Mark Leibovit was ranked the #1 U.S. Stock Market Timer and was previously ranked #1 Intermediate U.S. Market Timer for the ten year period December, 1997 to 2007.

He was a 'Market Maker' on the Chicago Board Options Exchange and the Midwest Options Exchange and then went on to work in the Research department of two Chicago based brokerage firms. Mr. Leibovit now publishes a series of newsletters at www.LeibovitVRNewsletters.com. He became a member of the Market Technicians Association in 1982.

Mr. Leibovit’s specialty is Volume Analysis and his proprietary Leibovit Volume Reversal Indicator is well known for forecasting accurate signals of trend direction and reversals in the equity, metals and futures markets. He has historical experience recognizing, bull and bear markets and signaling alerts prior to market crashes. His indicator is currently available on the Metastock platform.

His comprehensive study on Volume Analysis, The Trader’s Book of Volume published by McGraw-Hill is a definitive guide to volume trading. It is now also published in Chinese. Mark has appeared in speaking engagements and seminars in the U.S. and Canada.

US drug control agency will move to reclassify marijuana in a historic shift, AP sources say

The DEA's proposal, which still must be reviewed by the White House Office of Management and Budget, would recognize the medical uses of cannabis and acknowledge it has less potential for abuse than some of the nation's most dangerous drugs. However, it would not legalize marijuana outright for recreational use.

The agency's move, confirmed to the AP on Tuesday by five people familiar with the matter who spoke on the condition of anonymity to discuss the sensitive regulatory review, clears the last significant regulatory hurdle before the agency's biggest policy change in over 50 years can take effect.

Once OMB signs off, the DEA will take public comment on the plan to move marijuana from its current classification as a Schedule I drug, alongside heroin and LSD. It moves pot to Schedule III, alongside ketamine and some anabolic steroids, following a recommendation from the federal Health and Human Services Department. After the public-comment period the agency would publish the final rule.

It comes after President Joe Biden called for a review of federal marijuana law in October 2022, and has moved to pardon thousands of Americans convicted federally of simple possession of the drug. He has also called on governors and local leaders to take similar steps to erase marijuana convictions.

TV news reporter detained by police, released amid Cal Poly Humboldt protest: 'Find a different job'

"Criminal records for marijuana use and possession have imposed needless barriers to employment, housing, and educational opportunities," Biden said in December. "Too many lives have been upended because of our failed approach to marijuana. It's time that we right these wrongs."

The election year announcement could help Biden, a Democrat, boost flagging support, particularly among younger voters.

Schedule III drugs are still controlled substances and subject to rules and regulations, and people who traffic in them without permission could still face federal criminal prosecution.

Some critics argue the DEA shouldn't change course on marijuana, saying rescheduling isn't necessary and could lead to harmful side effects.

On the other end of the spectrum, others argue say marijuana should be dropped from the controlled-substances list completely and instead regulated like alcohol.

Federal drug policy has lagged behind many states in recent years, with 38 having already legalized medical marijuana and 24 legalizing its recreational use.

That's helped fuel fast growth in the marijuana industry, with an estimated worth of nearly $30 billion. Easing federal regulations could reduce the tax burden that can be 70% or more for businesses, according to industry groups. It could also make it easier to research marijuana, since it's very difficult to conduct authorized clinical studies on Schedule I substances.

The immediate effect of rescheduling on the nation's criminal justice system would likely be more muted, since federal prosecutions for simple possession have been fairly rare in recent years. Biden has already pardoned thousands of Americans convicted of possessing marijuana under federal law.

https://abc7.com/marijuana-reclassification-us-drug-control-agency-will-move-to-reclassify-cannabis-in-a-historic-shift-ap-sources-say/14746409/

Stocks End Sharply Lower Ahead Of Fed Policy

Stock prices went down south on Wall Street on Tuesday, sliding lower and lower after a weak start, as concerns about inflation and uncertainty about the Fed's interest rate moves rendered the mood bearish.

The central bank, which is scheduled to announce its monetary policy on Wednesday, is widely expected to leave interest rate unchanged. The accompanying statement and Fed Chair Jerome Powell's post meeting press conference for clues about future interest rate moves.

Investors digested a mixed batch of earnings updates, and some disappointing economic data.

The major averages all ended sharply lower, with the Nasdaq suffering a more pronounced loss. The Dow ended down by 570.17 points or 1.49 percent at 37,815.92. The S&P 500 dropped 80.48 points or 1.57 percent to 5,035.69, while the Nasdaq tumbled 325.26 points or 2.04 percent to settle at 15,657.82.

A report from MNI Indicators showed Chicago-area business unexpectedly contracted at an accelerated rate in the month of April.

The report said the Chicago business barometer dropped to 37.9 in April from 41.4 in March, with a reading below 50 indicating contraction. Economists had expected the index to rise to 44.9.

With the unexpected decrease, the Chicago business barometer fell to its lowest level since November 2022.

A report released by the Conference Board showed consumer confidence in the U.S. deteriorated by much more than expected in the month of April.

The Conference Board said its consumer confidence index slid to 97.0 in April from a downwardly revised 103.1 in March. Economists had expected the index to dip to 140.0 from the 104.7 originally reported for the previous month.

Meanwhile, data from the Labor Department showed labor costs in the U.S. rose more than expected last quarter, up by 1.2%, indicating a rise in wage pressures.

Microsoft Corporation shares dropped about 3.2 percent. Amazon ended down by 3.3 percent. Apple Inc., NVIDIA Corporation, Alphabet, Meta Platforms, JP Morgan Chase, Oracle, Chevron, Bank of America, Exxon Mobil, Visa Inc and Walmart ended with sharp to moderate losses.

Eli Lilly and Company shares rallied nearly 6 percent, after the company reported stronger than expected quarterly earnings. 3M Company surged higher after reporting strong first quarter earnings.

PayPal shares climbed higher after the company said its total payment volume in the first quarter rose by 14% to $403.9 billion.

In overseas trading, Asian stocks ended higher on Tuesday, with Chinese markets underperforming after the release of mixed PMI data.

European stocks closed weak after a cautious session ahead of the Federal Reserve's monetary policy meeting. Investors digested the latest batch of economic data from the region.

The pan European Stoxx 600 dropped 0.68 percent. The U.K.'s FTSE 100 edged down 0.04 percent, Germany's DAX and France's CAC 40 ended down 1.03 percent and 0.99 percent, respectively.

Preliminary flash estimate from Eurostat showed that the euro area economy expanded in the first quarter after two consecutive declines, with gross domestic product growing by more-than-expected 0.3% on quarter following a 0.1% fall each in the fourth and third quarters of 2023.

The German economy also avoided recession in the first quarter, with GDP growing more-than-expected 0.2% sequentially in the first quarter, in contrast to the revised 0.5% decrease in the preceding period.

Meanwhile, headline inflation in the euro area came in at 2.4% in April, matching forecasts. On a monthly basis, inflation was 0.6%.

In commodities, West Texas Intermediate Crude oil futures for June ended down by $0.70 at $81.93 a barrel. Gold futures ended down by $54.00 or about 2.3% at $2,291.40 an ounce.

In the currency market, the dollar was at 1.0671 against the Euro, and fetching 157.83 yen a unit.

Pastor attacks WOKE

https://tinyurl.com/22js9nxa

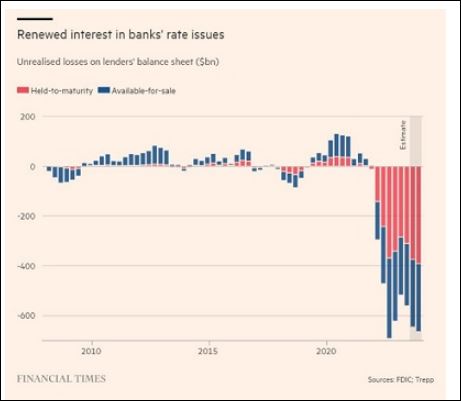

Bank Failures Begin Again: Philly's Republic First Seized By FDIC -Zero Hedge

by Tyler Durden

Who could have seen that coming?

Admittedly, we were a couple of weeks off, but trouble has been brewing in the banking sector and tonight - after the close - we get the first bank failure of the year.

The FDIC just seized the troubled Philadelphia bank, Republic First Bancorp and and struck an agreement for the lender’s deposits and the majority of its assets to be bought by Fulton Bank.

Republic Bank had about $6 billion of assets and $4 billion of deposits at the end of January, according to the FDIC (considerably smaller than the $100-200BN assets with SVB and Signature).

The FDIC estimated the failure will cost the deposit insurance fund $667 million.

As The Wall Street Journal reports, Republic First had for months struggled to stay afloat.

Around half of its deposits were uninsured at the end of 2023, according to FDIC data.

Its total equity, or assets minus liabilities, was $96 million at the end of 2023, according to FDIC filings.

That excluded $262 million of unrealized losses on bonds that it labeled “held to maturity,” which means the losses hadn’t counted on its balance sheet.

Its stock, which was delisted from Nasdaq in August, had been near zero.

Republic Bank’s 32 branches across New Jersey, Pennsylvania and New York will reopen as branches of Fulton Bank on Saturday, according to a statement from the FDIC.

Depositors of Republic Bank will become depositors of Williamsport, Pennsylvania-based Fulton Bank, the regulator said.

You should not be surprised given that rates are higher now than they were at the start of the SVB crisis - which means, unless banks have hedged hard or dumped their bonds at a loss, they are even more underwater.

An estimated 59 or more tornadoes tear across America's heartland, leaving catastrophic destruction in multiple states

Dozens of tornadoes swept across America's heartland, impacting millions of residents and leaving a trail of destruction.

Twenty million Americans, from Texas to Iowa, are on alert for twisters, large hail and up to 70 mph winds.

There were at least 59 reported tornadoes across Texas, Oklahoma, Kansas, Nebraska and Iowa as of 7 p.m. ET, according to the National Weather Service.

https://www.nbcnews.com/news/us-news/texas-hit-storms-flash-flooding-midwest-begins-clean-operation-rcna149738

Editor: Did you ever notice the media LOVES covering weather and geocosmic disasters? Why do you think?

Russia Spooks US With Space Nukes Pivot

Russia has vetoed a draft resolution before the United Nations Security Council banning nuclear weapons in space, spooking the United States. Moscow on Wednesday blocked the resolution, which was drafted by the U.S. and Japan. It would have reaffirmed the obligation of countries to comply with the 1967 Outer Space Treaty—not to place any objects carrying nuclear weapons or any other kinds of weapons of mass destruction in orbit around the Earth.

Cheap Russian drones overwhelm US-made Abrams tanks, taken out of action

Ukrainian forces are withdrawing US-provided Abrams M1A1 main battle tanks from the front lines after at least five have been destroyed by cheap Russian drones, according to the AP.

Russia will target NATO nuclear weapons in Poland if they appear, TASS says

Russia will make NATO nuclear weapons in Poland one of its primary targets if they are deployed there, the TASS news agency cited Russian Deputy Foreign Minister Sergei Ryabkov as saying on Thursday.

."..Moves in this direction will not provide greater security (for Poland or other nations that host such weapons)," TASS quoted Ryabkov as saying.

US troops begin constructing Gaza pier, aiming to have it operational by early May

US troops have begun constructing a maritime pier off the coast of Gaza with the aim of speeding up the flow of humanitarian aid into the enclave when it becomes operational in May, the Pentagon said on Thursday.

US President Joe Biden announced the construction of the pier in March as aid officials implored Israel to ease access for relief supplies into Gaza’s overland routes. Whether the pier will ultimately succeed in boosting humanitarian aid is unclear, as international officials warn of a risk of famine in northern Gaza.

The port sits just southwest of Gaza City, a little north of a road bisecting Gaza that the Israeli military built during the fighting.

THE PRESIDENT'S WORKING GROUP ON FINANCIAL MARKETS

Known colloquially as the Plunge Protection Team, or "(PPT)" was created by Executive Order 12631,[1] signed on March 18, 1988, by United States President Ronald Reagan.

As established by the executive order, the Working Group has three purposes and functions:

"(a) Recognizing the goals of enhancing the integrity, efficiency, orderliness, and competitiveness of our Nation's financial markets and maintaining investor confidence, the Working Group shall identify and consider:

(1) the major issues raised by the numerous studies on the events in the financial markets surrounding October 19, 1987, and any of those recommendations that have the potential to achieve the goals noted above; and

(2) the actions, including governmental actions under existing laws and regulations (such as policy coordination and contingency planning), that are appropriate to carry out these recommendations.

(b) The Working Group shall consult, as appropriate, with representatives of the various exchanges, clearinghouses, self-regulatory bodies, and with major market participants to determine private sector solutions wherever possible.

(c) The Working Group shall report to the President initially within 60 days (and periodically thereafter) on its progress and, if appropriate, its views on any recommended legislative changes."

Plunge Protection Team

"Plunge Protection Team" was originally the headline for an article in The Washington Post on February 23, 1997, and has since been used by some as an informal term to refer to the Working Group. Initially, the term was used to express the opinion that the Working Group was being used to prop up the stock markets during downturns.[5 Financial writers for British newspapers The Observer and The Daily Telegraph, along with U.S. Congressman Ron Paul, writers Kevin Phillips (who claims "no personal firsthand knowledge" and John Crudele,[8] have charged the Working Group with going beyond their legal mandate.[failed verification] Charles Biderman, head of TrimTabs Investment Research, which tracks money flow in the equities market, suspected that following the 2008 financial crisis the Federal Reserve or U.S. government was supporting the stock market. He stated that "If the money to boost stock prices did not come from the traditional players, it had to have come from somewhere else" and "Why not support the stock market as well? Moreover, several officials have suggested the government should support stock prices."

In August 2005, Sprott Asset Management released a report that argued that there is little doubt that the PPT intervened to protect the stock market.[10] However, these articles usually refer to the Working Group using moral suasion to attempt to convince banks to buy stock index futures.

Former Federal Reserve Board member Robert Heller, in the Wall Street Journal, opined that "Instead of flooding the entire economy with liquidity, and thereby increasing the danger of inflation, the Fed could support the stock market directly by buying market averages in the futures market, thereby stabilizing the market as a whole." Author Kevin Phillips wrote in his 2008 book Bad Money that while he had no interest "in becoming a conspiracy investigator", he nevertheless drew the conclusion that "some kind of high-level decision seems to have been reached in Washington to loosely institutionalize a rescue mechanism for the stock market akin to that pursued...to safeguard major U.S. banks from exposure to domestic and foreign loan and currency crises." Phillips infers that the simplest way for the Working Group to intervene in market plunges would be through buying stock market index futures contracts, either in cooperation with major banks or through trading desks at the U.S. Treasury or Federal Reserve.

What is the Plunge Protection Team?

(PPT) is an informal term for the Working Group on Financial Markets. The working group was created in 1988 by then U.S President Ronald Reagan following the infamous October 1987 Black Monday crash. It was formed to re-establish consumer confidence and take steps to achieve economic and market stability in the aftermath of the market crash. The U.S president consults with the team during times of economic uncertainty and turbulence in the markets.

The Working Group on Financial Markets’ informal name “Plunge Protection Team” was coined and popularized by The Washington Post in 1997.

What does the Plunge Protection Team Do?

The Plunge Protection Team was initially formed to advise the president and regulatory agencies on countering the negative impacts of the stock market crash of 1987. However, the team has continued to report to various presidents since that stock market crash and has met various U.S presidents on important financial matters over the years.

The team was believed to be behind the rally in the stock market shortly after a hefty drop in the Dow Jones Industrial Average (DJIA) on February 05, 2018. As per some market observers, after the plunge, the market made a smart recovery in the following days, which may have been a result of heavy buying by the Plunge Protection Team.

Who is on the plunge protection team?

The PPT several top government economic and financial officials. The Secretary of the Treasury heads the group, while the Chair of the Board of Governors of the Federal Reserve, the Chair of the Commodity Futures Trading Commission, and the Chair of the Securities and Exchange Commission, are also part of the team.

Why is the PPT secretive?

The Plunge Protection Team’s meetings or activities aren’t covered by the media, which gives rise to speculations and conspiracy theories about the team. The probable reason behind the secretive nature of its activities is that it reports only to the president. Some observers opine that the team’s role is not only limited to giving recommendations to the president; rather, the team intervenes in the market and artificially props up stock prices.

Critics claim that the members connive with big banks and profit from stock markets by carrying out trades on different stock exchanges when prices decline. They then artificially prop up the prices as part of their market stabilization efforts and profit from their transactions.

When does/have the PPT meet?

Although very little has come out in the mainstream media about the group’s activities, there have been some instances when the team’s meetings were reported. For example, in 1999, the team proposed to congress to incorporate some changes in the derivatives markets regulations. The last reported meeting of the group, at the time of this writing in June 2022, was in December 2018 when Treasury Secretary Steven Mnuchin headed the teleconference with the group’s members. Representatives from the Federal Deposit Insurance Corporation and the Comptroller of the Currency also attended the meeting.

Before the teleconference that took place on December 24, 2018, the S&P 500 and the DJIA had been under pressure for the whole month. But after Christmas, the DJIA and the S&P 500 both recovered and reversed most of the losses in the next few days. Conspiracy theorists attribute the recovery and gains in the indices to the intervention by the Plunge Protection Team.

Final Thoughts

The Working Group on Financial Markets serves an important function: to advise the president on financial markets and economic affairs. Because the exact nature of the group’s activities or recommendations haven't been made public, some critics of the group blame the group for market intervention and artificially propping up stocks’ prices. However, some market observers believe that the team’s quiet activities are excused as it reports directly to the president.

The Exchange Stabilization Fund protects the FED.

We already know the FED is lying that raising interest rates will reduce price inflation. The Exchange Stabilization Fund (ESF) is an emergency reserve account that can be used by the U.S. Department of Treasury to mitigate instability in various financial sectors, including credit, securities, and foreign exchange markets. The U.S. Exchange Stabilization Fund was established at the Treasury Department by a provision in the Gold Reserve Act of 1934.

https://en.wikipedia.org/wiki/

Gold market manipulation: Why, how, and how long? (2021 edition)

https://gata.org/node/20925

https://tinyurl.com/2rd9wv52

OPPORTUNITY TO ACCESS MARK LEIBOVIT'S PROPRIETARY VOLUME REVERSAL INDICATOR - THIS IS THE ONLY PLACE TO DO IT!

https://www.metastock.com/prod

FOLKS THIS ALL YOU NEEDED TO KNOW! HISTORICALLY A GOOD SIGN THAT WE ARE AT OR NEAR A MARKET TOP = BULLISH MEDIA HEADLINES LIKE THIS. RECALL THE MARCH 10, 2000 TOP HEADLINE IN THE WALL STREET JOURNAL (BELOW) RIGHT AT THE TOP!

DID YOU MISS THE RECENT METASTOCK MARK LEIBOVIT WEBINAR - POWERPOINT?

https://tinyurl.com/yc45s35c

COME ON, DAD. IT'S TIME TO EAT

DISCLAIMER:

WE ARE NOT FINANCIAL ADVISORS AND DO NOT PROVIDE FINANCIAL ADVICE

The website, LeibovitVRNewsletters.com, is published by LeibovitVRNewsletters LLC.

In using LeibovitVRnewsletters.com (a/k/a LeibovitVRNewsletters LLC) you agree to these Terms & Conditions governing the use of the service. These Terms & Conditions are subject to change without notice. We are publishers and are not registered as a broker-dealer or investment adviser either with the U.S. Securities and Exchange Commission or with any state securities authority.

All stocks and ETFs discussed are HYPOTHETICAL and not actual trades whose actual execution may differ markedly from prices posted on the website and in emails. This may be due internet connectivity, quote delays, data entry errors and other market conditions. Hypothetical or simulated performance results have certain inherent limitations as to liquidity and execution among other variables. PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE FORECASTING ACCURACY OR PROFITABLE TRADING RESULTS.

All investments are subject to risk, which should be considered on an individual basis before making any investment decision. We are not responsible for errors and omissions. These publications are intended solely for information and educational purposes only and the content within is not to be construed, under any circumstances, as an offer to buy or to sell or a solicitation to buy or sell or trade in any commodities or securities named within.

All commentary is provided for educational purposes only. This material is based upon information we consider reliable. However, accuracy is not guaranteed. Subscribers should always do their own investigation before investing in any security. Furthermore, you cannot be assured that your will profit or that any losses can or will be limited. It is important to know that no guarantee of any kind is implied nor possible where projections of future conditions in the markets are attempted.

Stocks and ETFs may be held by principals of LeibovitVRNewsletters LLC whose personal investment decisions including entry and exit points may differ from guidelines posted.

LeibovitVRNewsletters.com cannot and do not assess, verify or guarantee the suitability or profitability of any particular investment. You bear responsibility for your own investment research and decisions and should seek the advice of a qualified securities professional before making any investment. As an express condition of using this service and anytime after ending the service, you agree not to hold LeibovitVRNewsletters.com or any employees liable for trading losses, lost profits or other damages resulting from your use of information on the Site in any form (Web-based, email-based, or downloadable software), and you agree to indemnify and hold LeibovitVRNewsletters.com and its employees harmless from and against any and all claims, losses, liabilities, costs, and expenses (including but not limited to attorneys' fees) arising from your violation of this agreement. This paragraph is not intended to limit rights available to you or to us that may be available under the federal securities laws.

For rights, permissions, subscription and customer service, contact the publisher at mark.vrtrader@gmail.com or call at 928-282-1275 or mail to 10632 N. Scottsdale Road B-426, Scottsdale, AZ 85254.

The Leibovit Volume Reversal, Volume Reversal and Leibovit VR are registered trademarks.

© Copyright 2024. All rights reserved.